Choosing the right ecommerce payment gateway is crucial for the success of your online store. Customers expect fast, secure, and smooth transactions and that’s only possible when you use reliable and widely-recognized payment gateways. Whether you’re just starting or scaling your business, selecting the right gateway can improve trust and increase your conversion rates. In this guide, we’ll explore 7 top-rated gateways used by thousands of e-commerce businesses worldwide and help you choose the one that fits your needs best.

Planning your store? Don’t miss our guide on how to build your own eCommerce website or explore a robust eCommerce PHP script ready to support modern payment integrations.

Why Choosing the Right E-commerce Payment Gateway Matters

A payment gateway is the technology that handles online transactions between your customers and your store. It’s more than just a payment tool, it directly affects customer trust, checkout speed, and security compliance.

Here’s why your choice of payment provider matters:

- User Experience: A fast and easy checkout increases sales.

- Security: Gateways must be PCI-DSS compliant to protect sensitive data.

- Global Support: A good gateway supports multi-currency and international transactions.

- Business Credibility: Recognized names like PayPal or Stripe build trust.

To see how payment gateways fit into a broader strategy, check out our eCommerce website features list.

What Makes a Payment Gateway “Reliable and Widely-Recognized”?

Not all payment gateways are created equal. Here’s what to look for:

- High Uptime – Your payments should never fail due to provider issues.

- Security Standards – Look for SSL encryption, tokenization, and fraud detection.

- Developer Support – Easy integration into your stack or CMS.

- Customer Trust – Familiar logos like Stripe and PayPal increase confidence.

- Transparent Pricing – No hidden charges or surprise fees.

Need help selecting a platform that supports these? Here’s our review of the best platforms to build an eCommerce website.

Top 7 Reliable and Widely-Recognized Payment Gateways for Ecommerce

1. Stripe

Stripe is one of the most popular ecommerce payment gateways, known for its powerful APIs, global reach, and robust feature set. It’s widely adopted by startups, SaaS platforms, and custom-built eCommerce websites thanks to its flexibility and developer-friendly tools.

Whether you’re running a small business or scaling a complex online store, Stripe offers a reliable, secure, and customizable payment solution.

✅ Pros of Using Stripe

- Easy to integrate with custom-coded websites and mobile apps

- Supports recurring billing, subscriptions, and one-click checkout

- Offers advanced fraud protection and machine-learning-based risk scoring

- Global reach with support for 135+ currencies and local payment methods

- Clean, user-friendly dashboard with detailed reporting tools

❌ Cons of Using Stripe

- Not the best option for beginners or non-technical users

- Payouts can take 2–7 days depending on your country

- Customer service can be slower for smaller accounts

- Not available in all countries (limited support in some regions)

Stripe Transaction Fees

| Region | Card Type | Fee Structure |

|---|---|---|

| United States | Domestic cards | 2.9% + 30¢ per transaction |

| United States | International cards | 3.9% + 30¢ per transaction |

| Europe (EEA) | EU cards (SEPA) | 1.4% + €0.25 |

| Europe (EEA) | Non-EU cards | 2.9% + €0.25 |

| India | All cards (INR) | 2% per transaction (GST extra) |

| Additional Fees | Currency conversion | +1% (if conversion involved) |

| Additional Fees | Disputed chargeback fee | $15 (refunded if won) |

Note: Fees may vary based on country, volume, and type of integration. Always check Stripe’s official pricing for your region.

Ideal for:

Developers, SaaS platforms, and store owners using frameworks like Laravel, Node.js, or custom PHP scripts like our eCommerce PHP script which supports Stripe integration out of the box.

2. PayPal

PayPal is one of the most reliable and widely-recognized payment gateways in the world, used by over 400 million active users. Known for its trust, ease of use, and buyer protection, PayPal remains a top choice for ecommerce payment gateways, especially for new stores or global marketplaces.

It allows customers to pay using their PayPal balance, credit/debit cards, and even local wallets in some regions. All without sharing financial details directly with the merchant.

✅ Pros of Using PayPal

- Instant brand trust and familiarity for customers

- Easy to set up — no coding knowledge required

- Accepts payments via PayPal balance, cards, bank transfers, and Pay Later options

- Built-in buyer and seller protection

- Available in over 200 countries and supports 25+ currencies

- Seamless checkout experience with hosted buttons or in-site integration

❌ Cons of Using PayPal

- Higher transaction fees than some competitors, especially internationally

- Account holds or freezes are more common during disputes or sudden volume spikes

- Limited customization of checkout flow unless using advanced integrations

- Payout to bank account may take 1–3 business days

PayPal Transaction Fees

| Region | Transaction Type | Fee Structure |

|---|---|---|

| United States | Domestic transactions | 2.9% + $0.30 per transaction |

| United States | International transactions | 4.4% + fixed fee (based on currency) |

| Europe (EEA) | EU cards | 2.9% + fixed fee |

| India | Export transactions (USD) | 4.4% + fixed fee (~$0.30) |

| Refunds | Full refund | Original fee not returned |

| Disputes | Chargeback fee | $20 per case (may be waived if won) |

For country-specific pricing, refer to PayPal’s fee guide.

Ideal for:

Merchants who want quick setup, built-in trust, and easy checkout without complex coding. Perfect for freelancers, digital product sellers, and global marketplaces.

For PHP-based platforms like ours, PayPal integrates smoothly with our eCommerce PHP script to help you start accepting payments instantly.

3. Square

Square is a versatile ecommerce payment gateway that’s especially popular among small to mid-sized businesses that operate both online and offline. Known for its sleek POS hardware and easy-to-use software, Square provides a unified solution for managing payments, inventory, and customer data across multiple sales channels.

✅ Pros of Using Square

- All-in-one platform for online, in-store, and mobile sales

- No monthly subscription required for basic features

- Built-in inventory, tax, and order management

- Offers website builder (Square Online) for quick launch

- Fast deposits (usually 1–2 business days)

❌ Cons of Using Square

- Limited global support (mainly available in the U.S., Canada, Australia, UK, Japan)

- Fewer advanced features compared to Stripe for developers

- May freeze accounts during unusual activity

- Limited currency and language support

Square Transaction Fees

| Region | Transaction Type | Fee Structure |

|---|---|---|

| United States | Online transactions | 2.9% + $0.30 per transaction |

| United States | In-person card payments | 2.6% + $0.10 per transaction |

| Canada | Online transactions | 2.9% + CA$0.30 per transaction |

| Refunds | Full or partial | Processing fee not refunded |

| Disputes | Chargeback fee | $0 (covered under Square’s protection) |

Note: Fees vary by country. Visit Square’s official pricing page for updated regional rates.

Ideal for:

Brick-and-mortar store owners, small businesses, and hybrid sellers looking for a simple yet effective payment gateway that combines both ecommerce and retail features.

If you plan to sell services or physical goods across multiple locations, make sure to include Square as part of your feature checklist. You can find more insights in our eCommerce website features list or explore platforms that integrate Square seamlessly in our best platforms to build an eCommerce website guide.

4. Razorpay

Razorpay is one of the most trusted ecommerce payment gateways in India, tailored for fast-growing startups and digital businesses. It supports a wide range of payment methods, including UPI, credit/debit cards, net banking, and popular digital wallets. With features like subscription billing, payment links, and automated settlements, Razorpay is a strong choice for Indian merchants looking for a modern and developer-friendly solution.

It’s fully compliant with Indian regulations and provides an exceptional checkout experience across web and mobile.

✅ Pros of Using Razorpay

- Supports UPI, cards, wallets, net banking, EMI, and PayLater

- Powerful API for custom integration

- Real-time settlements (optional with RazorpayX)

- Offers smart features like payment links, invoices, and subscriptions

- PCI-DSS and ISO certified with advanced fraud detection

❌ Cons of Using Razorpay

- Available only in India

- International cards supported only with special approval

- Payouts can take longer if compliance verification is pending

- Customer support can be delayed during peak periods

Razorpay Transaction Fees

| Payment Method | Fee Structure |

|---|---|

| Domestic Cards (Visa, Mastercard, Rupay) | 2% + GST per transaction |

| UPI | 0% (limited to ₹2000 cap in some plans) |

| Wallets (Paytm, Mobikwik, etc.) | 3% + GST |

| Net Banking | 2% + GST |

| EMI (Credit Card) | 2% – 3% + GST |

| International Cards | 3% + GST |

| Refunds | No charge; fees not returned |

| Chargebacks | ₹300 per dispute (waived if won) |

Always refer to Razorpay Pricing for the most current and plan-specific details.

Ideal for:

Indian eCommerce businesses, SaaS platforms, freelancers, and marketplaces. Razorpay is perfect for platforms built with Laravel, PHP, or custom stacks and is easily integrable with scripts like our eCommerce PHP script that support payment APIs.

For businesses targeting Indian customers or using UPI at scale, Razorpay should be a top consideration. Be sure to include it when evaluating your ecommerce website features for the Indian market.

5. Mollie

Mollie is a rapidly growing ecommerce payment gateway in Europe, trusted for its ease of use, fast onboarding, and strong support for local payment methods. It’s an ideal choice for European businesses looking to accept payments across multiple countries with minimal technical setup.

Mollie integrates easily with popular CMSs and custom-built stores, offering a developer-friendly API alongside plug-and-play plugins for WooCommerce, Magento, and more.

✅ Pros of Using Mollie

- Quick onboarding with no lengthy approval process

- Transparent pricing with no monthly or hidden fees

- Supports European payment methods like iDEAL, Bancontact, Klarna, and SEPA

- Developer-friendly APIs and detailed documentation

- Multi-currency support with localized checkouts

❌ Cons of Using Mollie

- Available primarily in Europe

- International card support may have higher fees

- Less suitable for marketplaces (limited split-payment support)

- Not ideal for very high-volume businesses needing custom rates

Mollie Transaction Fees

| Payment Method | Fee Structure |

|---|---|

| iDEAL (Netherlands) | €0.29 per transaction |

| Bancontact (Belgium) | 1.15% + €0.10 |

| SEPA Credit Transfer | €0.25 |

| Visa, Mastercard | 1.8% + €0.25 per transaction |

| Klarna Pay Later | 2.99% + €0.35 |

| PayPal (via Mollie) | 3.4% + €0.35 |

| Refunds | No additional fee, but original fee is kept |

| Chargebacks | €19 per dispute |

Fees may vary depending on your country and volume. Always check Mollie’s official pricing for the latest info.

Ideal for:

European merchants, subscription-based platforms, and small-to-mid-sized online stores wanting to provide a localized and trustworthy checkout experience.

If you’re building an eCommerce site with a European customer base, Mollie is a powerful option to consider. Check out our full ecommerce website feature list to make sure you’re integrating a gateway that meets your region’s expectations.

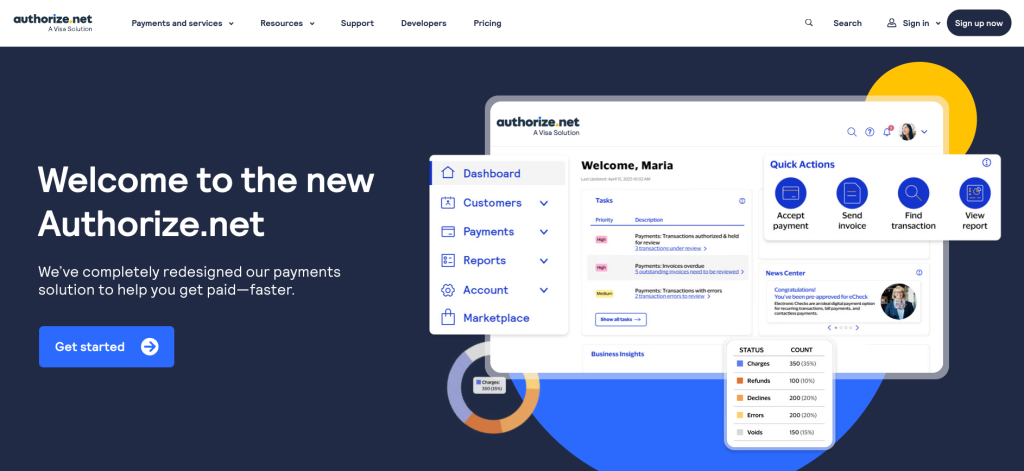

6. Authorize.Net

Authorize.Net, a Visa-owned service, is one of the oldest and most widely-recognized payment gateways trusted by enterprise-level businesses and established online retailers. Known for its reliability, security, and scalability, Authorize.Net supports both online and in-person transactions.

Unlike modern plug-and-play tools, it’s better suited for businesses with a development team or agencies managing custom integrations. That said, it’s still a solid choice for those who need enterprise-grade tools and fraud protection.

✅ Pros of Using Authorize.Net

- Owned by Visa — highly reliable and secure

- Supports all major payment methods (cards, ACH, eChecks)

- Recurring billing, customer profiles, and invoicing tools

- Industry-leading fraud detection suite (AFDS)

- Can be used as a payment gateway only or full merchant account

❌ Cons of Using Authorize.Net

- More complex to set up than Stripe or PayPal

- Monthly gateway fee even if unused

- Limited global coverage (primarily U.S., Canada, Australia, UK, EU)

- Requires merchant account (unless using all-in-one plan)

Authorize.Net Transaction Fees

| Plan Type | Fee Structure |

|---|---|

| All-in-One (with merchant account) | 2.9% + $0.30 per transaction + $25/month |

| Gateway Only Plan | $0.10 per transaction + $25 monthly fee |

| ACH/eCheck Processing | 0.75% per transaction |

| Setup Fee | $0 |

| Chargeback Fee | $25 per dispute |

| Refunds | Fees are not refunded |

Visit Authorize.Net pricing page for country-specific or enterprise plan details.

Ideal for:

Mature eCommerce businesses, subscription-based platforms, wholesalers, or B2B portals needing high reliability, compliance, and fraud controls.

If you’re planning to scale your operations and handle higher volumes securely, Authorize.Net is a strong candidate. Just ensure your platform supports API or AIM integration. Our eCommerce PHP script can be customized to work with enterprise-grade gateways like this.

Need help choosing the right platform? Read our guide on how to build your own eCommerce website to get started the right way.

7. Cashfree

Cashfree is one of India’s fastest-growing ecommerce payment gateways, offering powerful APIs, quick settlements, and advanced features like split payments and instant refunds. It’s trusted by over 100,000 Indian businesses and is especially popular with marketplaces, subscription services, and online education platforms.

With easy integration for web and mobile apps, Cashfree enables merchants to automate collections, manage payouts, and improve the customer experience across all payment touchpoints.

✅ Pros of Using Cashfree

- Supports 100+ payment modes, including UPI, cards, wallets, and net banking

- Offers split payments for marketplaces and vendor platforms

- Instant settlements (optional feature)

- Easy-to-use dashboard and smart analytics

- Developer-friendly with SDKs and plugins for major frameworks

❌ Cons of Using Cashfree

- Limited to Indian businesses and INR currency

- Global payment support requires additional documentation

- Some advanced features (like instant refunds) come with extra costs

- Support response times may vary for smaller merchants

Cashfree Transaction Fees

| Payment Method | Fee Structure |

|---|---|

| UPI | 0% – 0.40% per transaction |

| Credit/Debit Cards | 1.90% – 2.65% + GST |

| Net Banking | 1.75% + GST |

| Wallets (Paytm, Mobikwik) | 2.25% + GST |

| EMI (Card-based) | 2.50% – 3.5% + GST |

| International Cards | 3.5% + GST |

| Refunds | No extra fee, but original fee not refunded |

| Chargebacks | ₹300 per dispute |

Latest pricing available on Cashfree’s official pricing page.

Ideal for:

Indian eCommerce platforms, service marketplaces, ed-tech platforms, and startups looking for fast, flexible, and automated payment workflows.

If you’re building a platform for the Indian market using Laravel or PHP, Cashfree is an excellent choice. Our eCommerce PHP script can be extended to support Cashfree’s API seamlessly for collecting and disbursing payments.

For more features to add to your eCommerce site, check out our complete eCommerce website features list and top design tips to boost your sales.

How to Choose the Right Gateway for Your Store

Ask these questions before committing:

- Does it support your country and currency?

- Are the transaction fees transparent and fair?

- Can it be integrated into your checkout flow without slowing it down?

- Does your eCommerce buildhttps://xgenious.com/how-to-launch-ecommerce-website/er support it natively?

Refer to our guide on 8 key features of an eCommerce website design to see how payment UX ties into overall design.

Boost SEO & Trust with Payment-Ready Pages

When optimizing your website, make sure to also optimize your internal links and structure. Our article on internal linking strategies shows how to connect key pages like your payment FAQs, shipping details, and refund policies to reduce bounce rate and improve trust signals especially on payment-related pages.

Final Thoughts

Reliable and widely-recognized payment gateways are more than just a technical integration. they’re part of the customer experience and your brand credibility. The 7 gateways listed here are proven to deliver consistent, secure, and fast payment processing for eCommerce stores in 2025 and beyond.

Ready to build your eCommerce site with secure payments from day one? Start with our eCommerce PHP script or read the full guide on how to build your own eCommerce website.

Frequently Asked Questions (FAQs)

What is an e-commerce payment gateway?

An e-commerce payment gateway is a service that processes online payments for your store. It securely transfers customer payment information between your website, their bank, and your payment processor, allowing you to accept credit cards, digital wallets, and other forms of online payments.

Which payment gateway is best for a new e-commerce website?

For beginners, PayPal and Stripe are the most reliable and widely-recognized payment gateways. They are easy to integrate, support multiple currencies, and are trusted by millions of users worldwide.

Are these payment gateways secure?

Yes, all the gateways mentioned in this article are PCI-DSS compliant and include advanced security features like tokenization, fraud detection, and encryption to protect both you and your customers.

Can I use multiple payment gateways on my website?

Absolutely. Many e-commerce platforms and PHP scripts allow you to offer more than one gateway, such as Stripe for cards and PayPal for digital wallets, giving your customers more flexibility at checkout.

Which payment gateway is best for Indian e-commerce businesses?

Razorpay and Cashfree are among the top choices for Indian e-commerce stores. They offer local payment options like UPI, net banking, wallets, and support for split payments.

Do I need a developer to integrate a payment gateway?

It depends on your platform. If you’re using a script like our eCommerce PHP script, integrations are usually plug-and-play or come with clear documentation. However, for custom sites, developer assistance may be needed.

What are the transaction fees for these gateways?

Fees vary by provider and location. For example, Stripe charges around 2.9% + $0.30 per transaction in most regions. Always check the official pricing page of each gateway before integrating it.

Can these gateways support recurring or subscription payments?

Yes. Gateways like Stripe, Razorpay, and Authorize.Net offer built-in support for recurring billing, making them ideal for subscription-based e-commerce models.

Which gateway should I choose for international customers?

Stripe, PayPal, and Mollie are excellent options for international payments, offering multi-currency support and global fraud protection systems.

How do I decide which payment gateway is right for my business?

Consider your business model, location, customer preferences, and platform compatibility. You can also read our guide on how to build your own eCommerce website to make an informed decision.